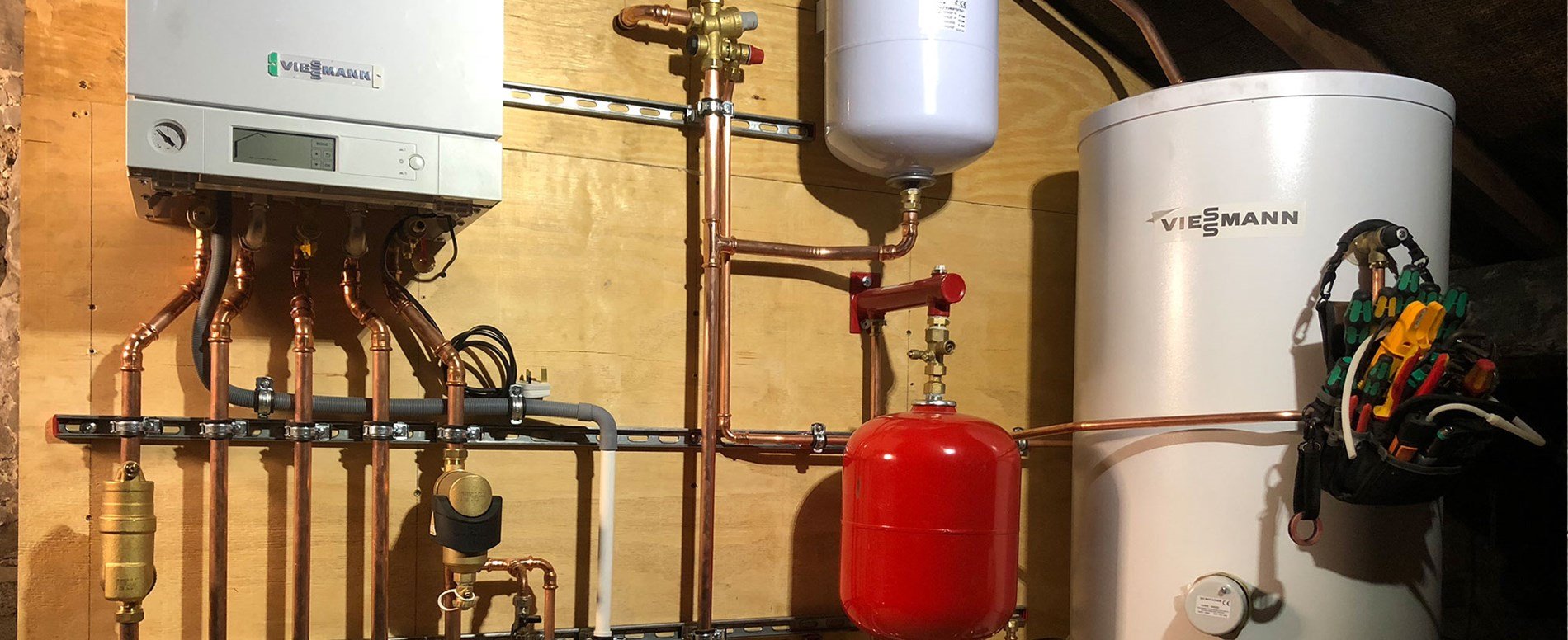

BOILER INSTALLATION FINANCE

To help spread the cost of your boiler installation, we offer a range of flexible finance options. A boiler is one of the most important appliances you can buy, as it keeps you warm, clean and turns your house into a home. Because of the role it plays, it’s important that the boiler you choose is safe, reliable and good quality. This can often come at a price.

That’s why we have a range of boiler finance options available - meaning you can choose to pay for your new boiler outright or over manageable, monthly payments to help spread the cost. Alternatively, you can pay a deposit based on the cost in the final quote, and the remainder of the cost, once the new boiler has been installed and you’re happy with the work. The size of the boiler and the complexity of the installation process can also affect the cost.

OVERVIEW

ON FINANCE

Pay deposit

Make additional payments

Spread the cost over a certain period

If you’d like to spread the cost of your new boiler, we can help arrange a loan to cover up to 100% of the installation costs.

PAY IN FULL

You can pay a deposit based on the cost in the final quote, and the remainder of the cost, once the new boiler has been installed and you’re happy with the work.

*Subject to application and financial circumstances. Terms & Conditions apply. Other options are available. Finance can be taken out and capital payments can be made at any time to reduce your loan.

HOW CAN I PAY?

Am I eligible?

As with any finance purchase, any credit you receive will be subject to application for a new boiler. There’s some criteria around your financial circumstances and borrowing that we’ll need to check.

On the date of the application, you must:

• Be minimum age of 18 at date of application.Not be subject to Bankruptcy or a Debt Relief Order (or Scottish equivalent).

• The credit check carried out will consider additional information relating to the performance of previous or existing commitments and any county court judgements.

You must be:

• A UK resident for the last 3 years minimum.

• Full time employed (16+hrs per week) / part time employed (up to 16hrs per week) / self-employed / retired / in receipt of disability allowance / homeowner.

• Have an individual gross income of £10,000 or more (or a joint income if married / living with partner / in civil partnership).

You must have:

• A mobile number

• A bank account that supports Direct Debit – in the name of the applicant and the only signatory to authorise a direct debit.

An eligibility check, which is a soft check and will not appear on your credit file, will take place before your application.

Contact us for any questions/enquiries you may have..